The organization was created to remove the legal and financial barriers that had long prevented americans from protecting property they owned in canada.

Donating land to charity canada.

This federal program provides extra tax benefits to the landowners who wish to donate ecologically significant land.

Developed property whether it s commercial residential multi family single units donating property may be the right option.

As an added benefit and to encourage the preservation of ecologically sensitive land the canadian government provides enhanced tax incentives for gifts of land and conservation easements to duc.

According to the cra you are considered to have disposed of real estate at its fair market value when it is donated to a registered canadian charity.

Donating to help victims of a disaster or other emergency questions and answers to help canadians donate for disaster relief.

Generally 50 of the capital gain that arises from the disposition of private corporation shares or real estate is subject to tax and must be reported on the donor s income tax return.

When you donate certain types of property to a charity including certified ecologically sensitive land you may be entitled to an inclusion rate of zero meaning none of the capital gain is.

Maybe you are thinking of donating to charity but lack the liquid assets to meet your philanthropic goals.

The capital gain taxes on disposition of the land is eliminated.

Information for donors claiming charitable tax credits report your charitable donations and claim your tax credits when you file your income tax return.

Whether you bought it at a tax sale for investment or received it as a inheritance we can put the land to use at our charity.

Donate land and save on taxes not every eligible charity wants land.

Donations of land and conservation agreements to the nature conservancy of canada may also qualify as an ecogift by environment canada.

Vacant land empty land is often a prime candidate for donations.

Donating land donating land or a conservation easement the core of american friends mission is permanent preservation of ecologically significant land in canada that is owned by us taxpayers.

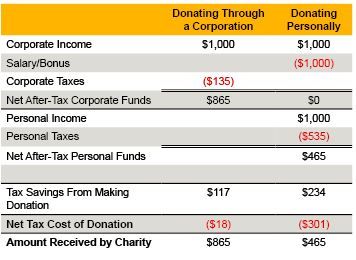

This can help you qualify for substantial tax savings and eliminate capital gains that would normally be due if lands were sold.

Donating appreciated real estate to charity or accepting real estate if you re a charity is one of those things that s difficult to generalize about but critical to understand.